Nowadays, the monitoring of all the statistics regarding exchange accounts and the management of all the potential forces that can lead to alterations, crucial data for all the traders, has become more accessible thanks to a well-known platform, called Trade-mate.io.

This platform constitutes the project of a very experienced team with significant contributions in the field of automated systems. In this platform, the traders can carry out exchanges either automatically or manually, and they can use Binance and Poloniex crypto exchanges as well. Other than that, the users can also benefit from the BitMEX trading platform via Trade-made.io, making their life easier.

Trading on BitMEX

BitMEX is a trading platform that provides to his users the ability to participate in the financial market worldwide by using the so-called bitcoins. This platform is the first one where investors are provided with crypto derivatives that give the possibility to execute transactions with a higher profit margin, with leverage up to X100.

Although, because of the emerging technical issues during the implementation of BitMEX via API have prevented many large exchange platforms of adopting it, that didn’t dissuade the Trade-mate.io of integrated it, widening its users’ potentials even more.

Minimizing the risk of loss

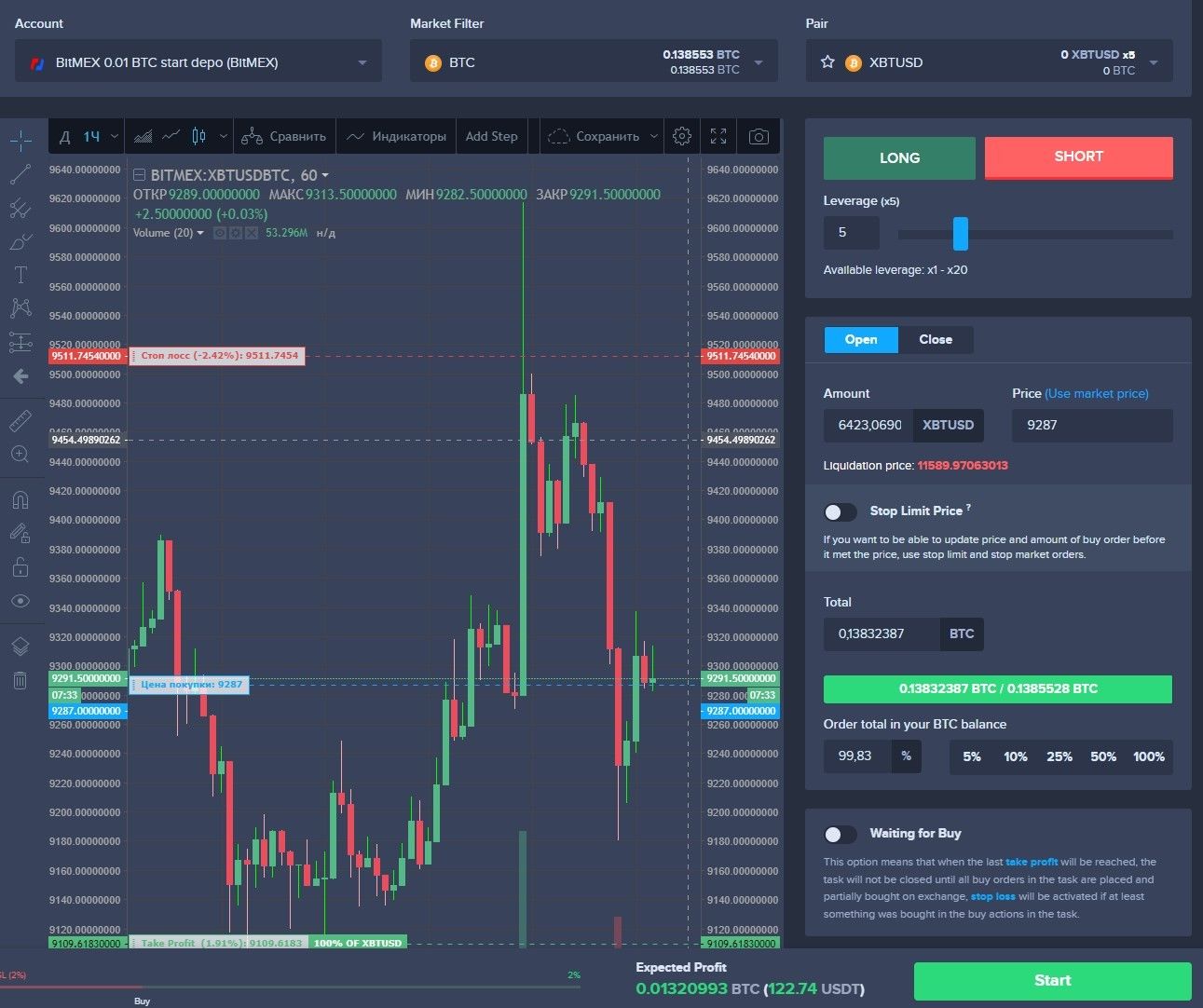

Even though the X100 leverage scenario is very attractive to all the traders, the risk of loss must not be overlooked. Even the most experienced traders are not fully protected from such a great risk ratio, as the price of the triggered order is too close to the elimination zone, which can lead to an X100 loss. On the grounds of that, Trade-mate.io has set an X20 limit at the trading leverage to protect its investors from a great loss of their deposits.

Cross-margin

Cross-leverage hides big risks, as it uses all the available funds in an account’s balance to cover an open position. If the price is moving in the right direction, the leverage will be reduced as well as the collateral due to the accumulated profit. Albeit, in the case, that the leverage will escalate, as a consequence, there will be a total loss of the initial funds. In other words, when the position is opened and the order is liquidated, the entire balance will be reset.

Because of its highly risky nature, the cross-leverage is not recommended for risk-averse investors. It may be advisable for risk-neutral users, as it offers the ability to calculate again the size of the leverage, which will vary within acceptable values.

Because of its high-risk nature, the Trade-mate.io does not support cross-leverage.

Why use Trade-mate.io platform

One of the most important features of the Trade-mate.io platform is the fact that an order is placed with a take profit and stop loss simultaneously and, they can be altered either automatically or manually, providing to the investor with the opportunity to make Smart Trade functions.

A Smart Trading process consists of two types of orders, the limit order, and the market order. In the first case, an order is placed at the price of interest and when it riches the specified level, the order is activated. In this case, the order is pending. In the case of the market order, the purchase or the sale of an instant market asset is made at that moment.

Trailing mode

The trailing mode is a Smart Trade’s function that rearranges the orders based on the specified parameters, allowing the trader to minimize the risk and to increase his profits. Trailing mode consists of three orders:

1. Trailing take profit

In this case, the order parameters change the value of floating take profit and the default setting is 1%. As the price attains the level of the determined take profit, the take profit is being automatically moved to the set value until the price is no longer changing.

2. Trailing stop loss

The difference with taking profit is that, in this case, instead of taking profit, the taking loss is the one that is moved as the price increases and it remains stable when the price is decreased.

3. Trailing ladder

Here, as soon as an order is opened, the take profit and stop loss are triggered concurrently. In more detail, when the price approaches the first level of taking profit, the stop loss is moved to the break-even point. This will continue until the price crosses the stop loss line and the sell is activated.

It should be emphasized that this mode is not included in the BitMEX platform or any other crypto exchange.

Edit a task

In the trade-mate.io platform, the traders are also able to edit the current task without canceling it, unlike with other crypto exchange users where the users are obliged to cancel the old task in order to create a new one.

In the Trade-mate platform, the task can be edited before the order is been activated. The traders are able to cancel the task, to change it in case they want to sell cryptocurrency when the price has reached desirable levels or to average it. By this can be benefit traders dealing with leverage, as once they have created an order, they are able to edit it in the meantime, making the whole process more simple.

Last but not least, in this platform, the traders possess the ability to change even the control panel and to make it comfortable for them to use it. They can move the elements in the control panel and adjust them at the most convenient for them positions by just dragging them around the screen.

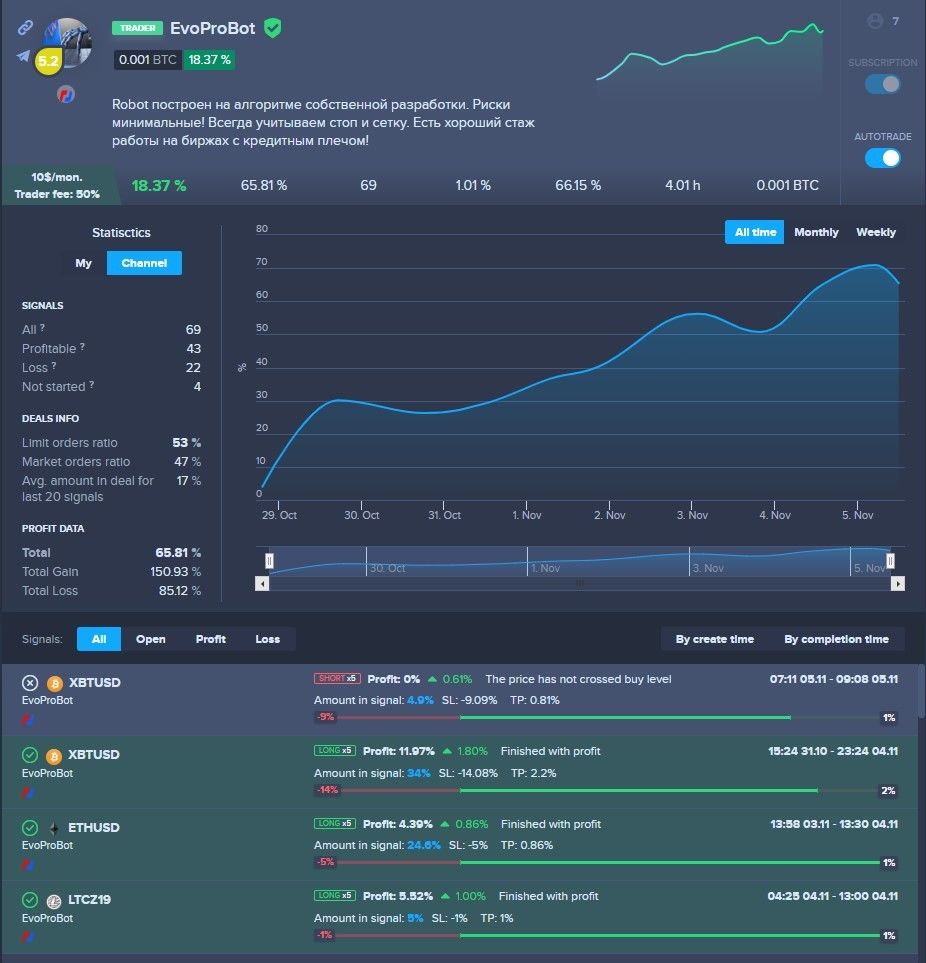

Copy on BitMEX

BitMEX gives the opportunity to its traders to copy trades from other trades, the so-called auto trading. In addition, traders who execute successful trading on the crypto market, they receive incomes from the subscribers. That’s why Trate-mate.io selects only the traders with the highest ratings in order to guide others. Again, for the safety of its users, the leverage for auto trading will be no more than X5. In this way, liquidating balances are prevented.